Erc Vancouver for Dummies

Table of ContentsWhat Does Erc Portland Do?Erc Vancouver Fundamentals ExplainedOur Erc Vancouver DiariesErc Vancouver Fundamentals ExplainedUnknown Facts About Employee Retention Credit VancouverExcitement About Erc PortlandThe Main Principles Of Erc Portland 3 Easy Facts About Employee Retention Credit Vancouver DescribedNot known Facts About Employee Retention Credit Vancouver

A federal government firm has actually gotten your firm to close or limit its hrs. During any type of quarter of 2020 or 2021, your business was entirely or partly closed down. The credit is only legitimate for the quarter(s) in which you were influenced by the interruption. OR Gross receipts for your business have gone down considerably.You may pick which quarters to compare. Bear in mind that you're contrasting the very first quarter to the first quarter, the 2nd quarter to the second quarter, and so on as the pandemic advances. If your firm certifies, as much as $10,000 in incomes and health-plan costs for each employee will be boosted by 70% (employee retention credit near me).

Our Erc Vancouver Ideas

A lot of these dining establishments at first assumed they would not be eligible for the credit report, but the standards to either fold or socially distance indoor dining-room allowed them to qualify under the partial closure examination. Despite not having a big revenue decrease overall, a single unit suggestion had the ability to get $300,000 in credit scores because of federal government orders over the year.

You may still be qualified for the credit report if your firm reduced hrs to facilitate sanitation, limited the solutions you provide, or can not access crucial devices because of COVID-19. Lots of business owners also assume they are disqualified for the ERC if their income has not stopped by 50% or if their company has actually increased in the previous year.

The Only Guide to Erc Portland

This is money you have currently paid to the IRS in payroll taxes for your W2 staff members. Cover Picture Credit Scores:/ Pressmaster/ Catastrophe Lending Advisors.

The 5-Minute Rule for Erc Vancouver

The COVID-19 pandemic has not only presented a worldwide health and wellness situation however a financial one also. Over the in 2014, organizations across the U.S. have actually been battling to keep their doors open. With mandated closures and also loss of income, the wellness of both staff members and employers is at stake.

Additionally, applicants would require to have 100 or fewer employees and were NOT allowed to request ERC if they had actually currently taken a PPP finance. (You needed to pick one or the various other). With the new regulations in December 2020, some of these needs have changed for the far better.

The Main Principles Of Employee Retention Credit Near Me

The tax credit is deducted from the tax obligations you owe as a service as well as is refundable. Here's what we recognize about the current target dates for ERC, qualification, and also whether we'll see this tax obligation credit once again in the future. It is still possible for you to claim the ERC due to the fact that the original program original site allowed organizations to assert this credit score for 3 years.

The exact same relates to gross receipts drops for your 2021 return. Another credentials is your supply chain as well as suppliers were impacted by the pandemic, suggesting production and also productivity were greatly reduced down. You were incapable to use the exact same number of solutions or items as you used to. An additional qualification is that you might not visit your clients on-site due to the constraints enforced by government order.

Getting The Employee Retention Credit Vancouver To Work

Business operating hours were heavily impacted throughout either 2020 or 2021. my site It is necessary to note that having actually experienced a lockdown is not a marker of ERC eligibility. Service operations need to have been impacted by a federal government order. Your service or organization size is what will certainly determine the wages that get the credit score.

In 2021, the worker count was expanded to 500 workers or much less. And also, you can make as much as 70% of earnings. Keeping that said, the quantity will include just what you would pay the employee during the last thirty days prior to organization closure. This consists of both incomes as well as healthcare costs.

About Employee Retention Credit Near Me

The draft is still in its early phases. The proposed costs still requires to pass the Us senate, Home, and the President. If this costs passes, qualified services might have the ability to continue to assert an ERC refund on their 2023 taxes or later. The essential to figuring out whether or not you should assert an RTC on your 2022 return rests on your pay-roll paperwork.

Constantly interested regarding individuals, her first task was fundraising for her college, where she spoke to specialists from all profession. When she isn't writing, she's checking out blockchain and design.

Get This Report about Erc Vancouver

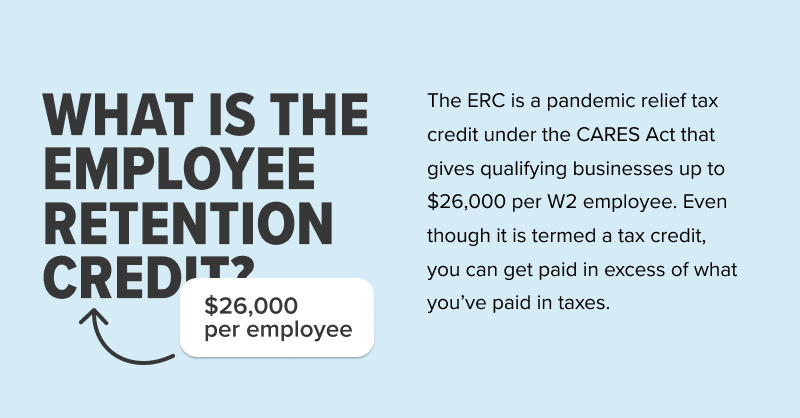

Have you heard of the Staff member Retention Debt? If you have not become aware of it, or you have not thought about seeking this support, take two mins to listen to Jen Kelsch, GAR Structure's Principal Financial Officer, as she right here shares 5 points you need to learn about the Staff member Retention Credit History (employee retention credit vancouver). The Staff member Retention credit history is a payroll tax credit that is refundable to companies.

Unknown Facts About Employee Retention Credit Vancouver

Yes; you can still certify for the worker tax obligation credit scores also if you took out Payroll Defense Program funds throughout the pandemic. The PPP supplied an excusable funding based on the incomes that they paid their workers during Covid.

More info can be discovered right here or by calling your monetary advisor (employee retention credit vancouver).

Comments on “Examine This Report about Erc Vancouver”